Independence Day marks the onset of the summer vacation season, although to a much lesser extent in 2020 due to global travel restrictions. While I’m stuck in the sweltering heat of Spain Tony managed to plot his escape from Chicago to some camping ground near Kern River, CA. I have very nice memories visiting there and one of the main advantages is that Sequoia National Park with its higher elevations and cooler temperatures is only three hours away.

If there is one thing I really miss about living in California then it is the amazing national parks. Don’t get me wrong, as the 2nd most visited country on earth Spain offers some gorgeous scenery. But IMO nothing compares with the natural splendor of California and once things settle down politically I’ll be sure to plan our next trip there.

Now from a trading perspective we are heading straight into the annual summer doldrums. Although June offers a slight bullish bias it’s obviously one of the least rewarding seasons of the year. Unless of course you are trading volatility and time decay, which is exactly what’s on the menu for the foreseeable future.

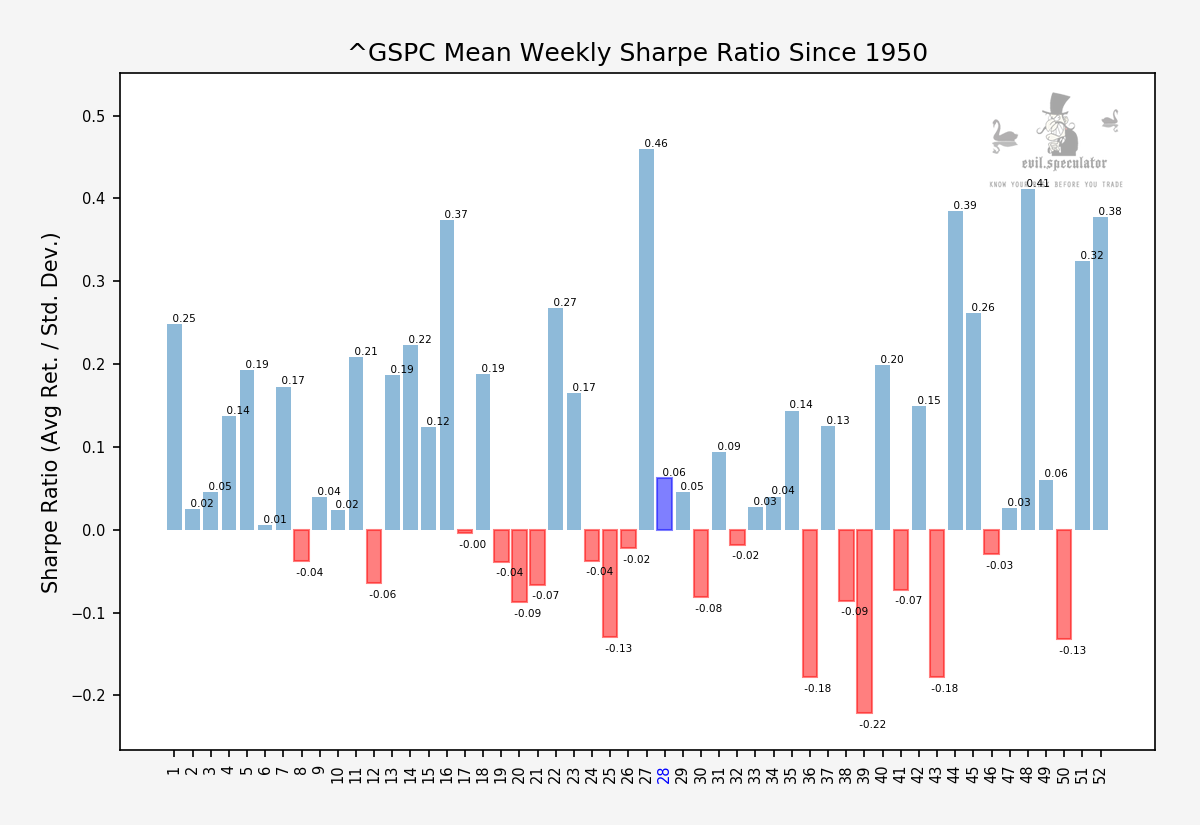

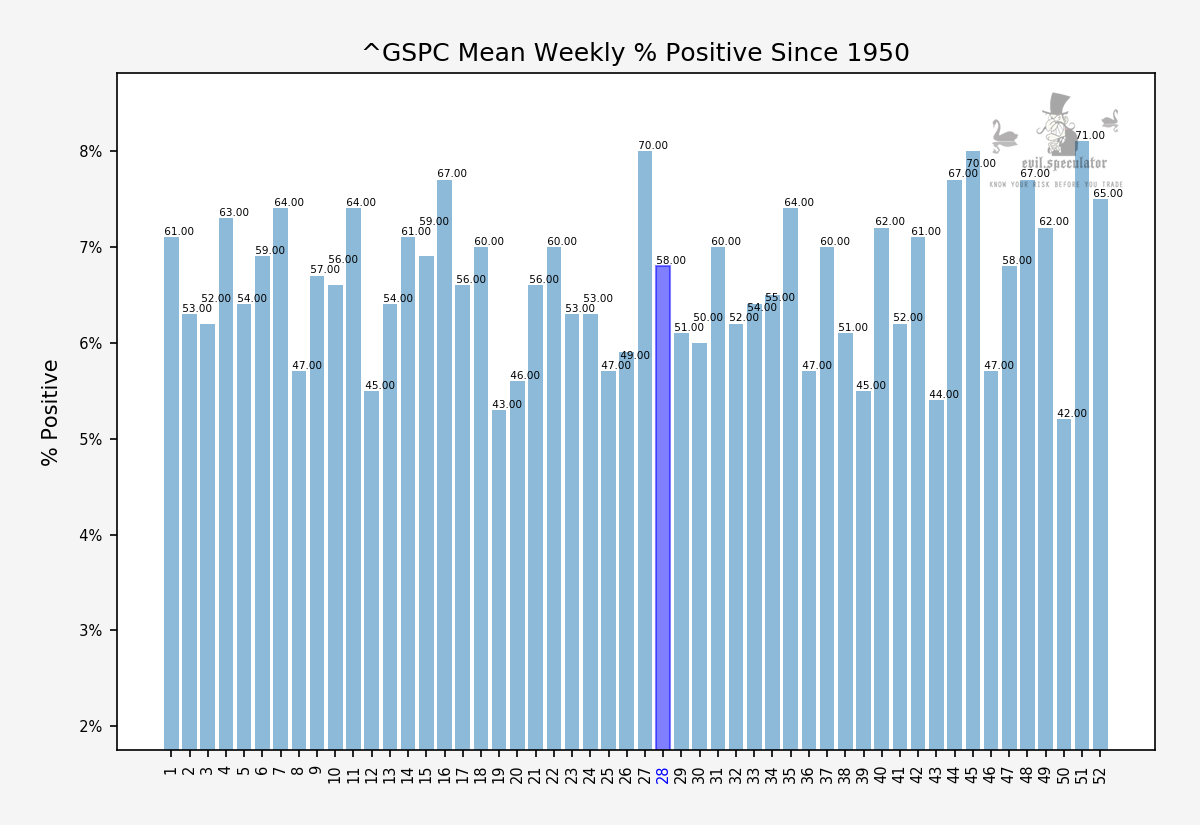

Week #28 has decent weekly positive stats at 58%, just don’t expect any large outlier moves.

More stats and market perspectives below the fold for my intrepid subs:

[MM_Member_Decision membershipId='(2|3)’]

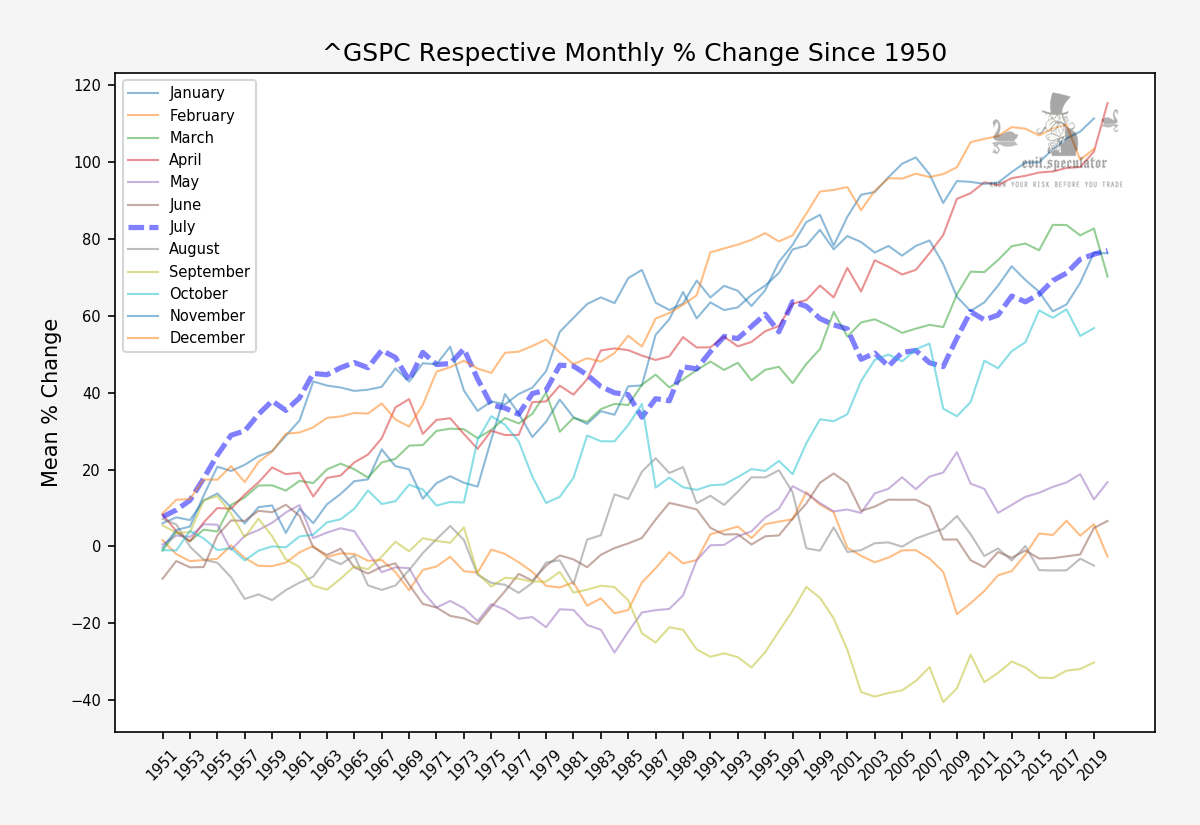

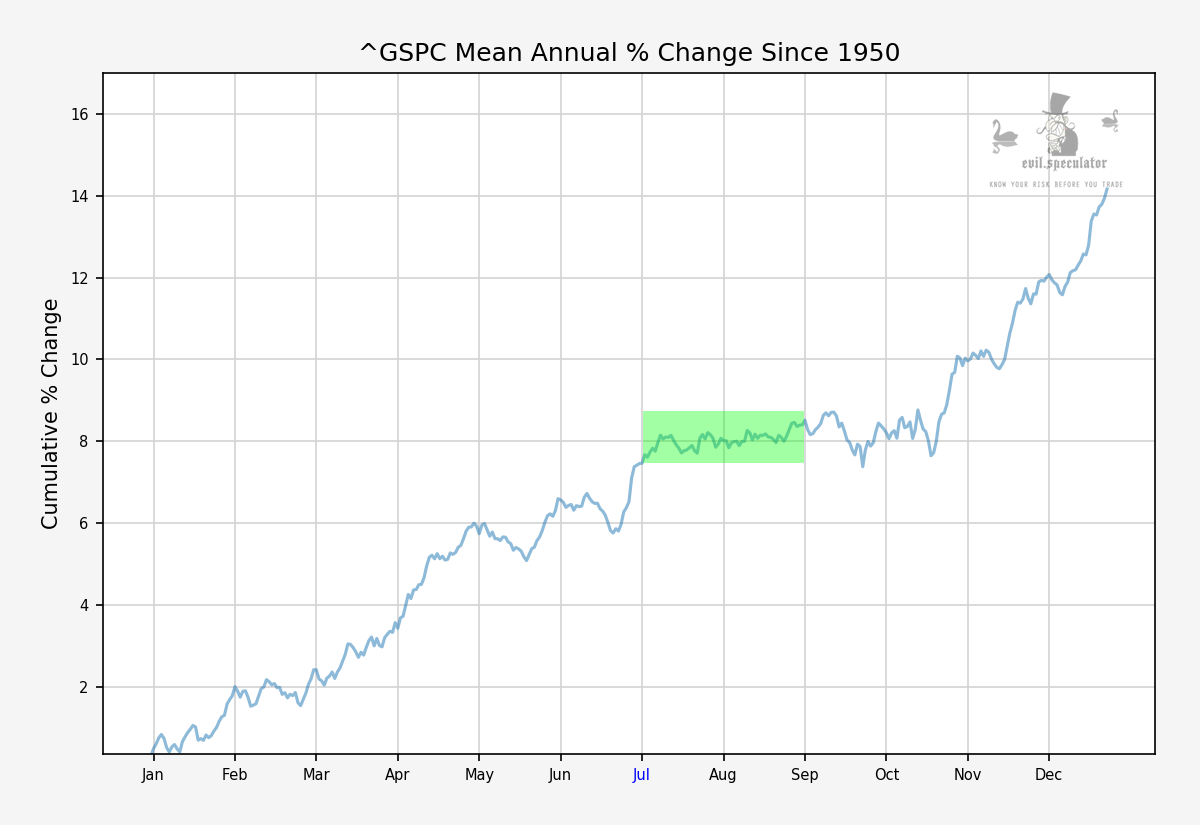

If you added the past 50 years together and averaged it then this graph is what you would get. As you can see both July and August are a complete waste of time for directional traders.

This is a similar graph but specific to each month. My apologies in advance if you are color blind – I did however highlight July with a thick blue dotted line so you can pick it out easier.

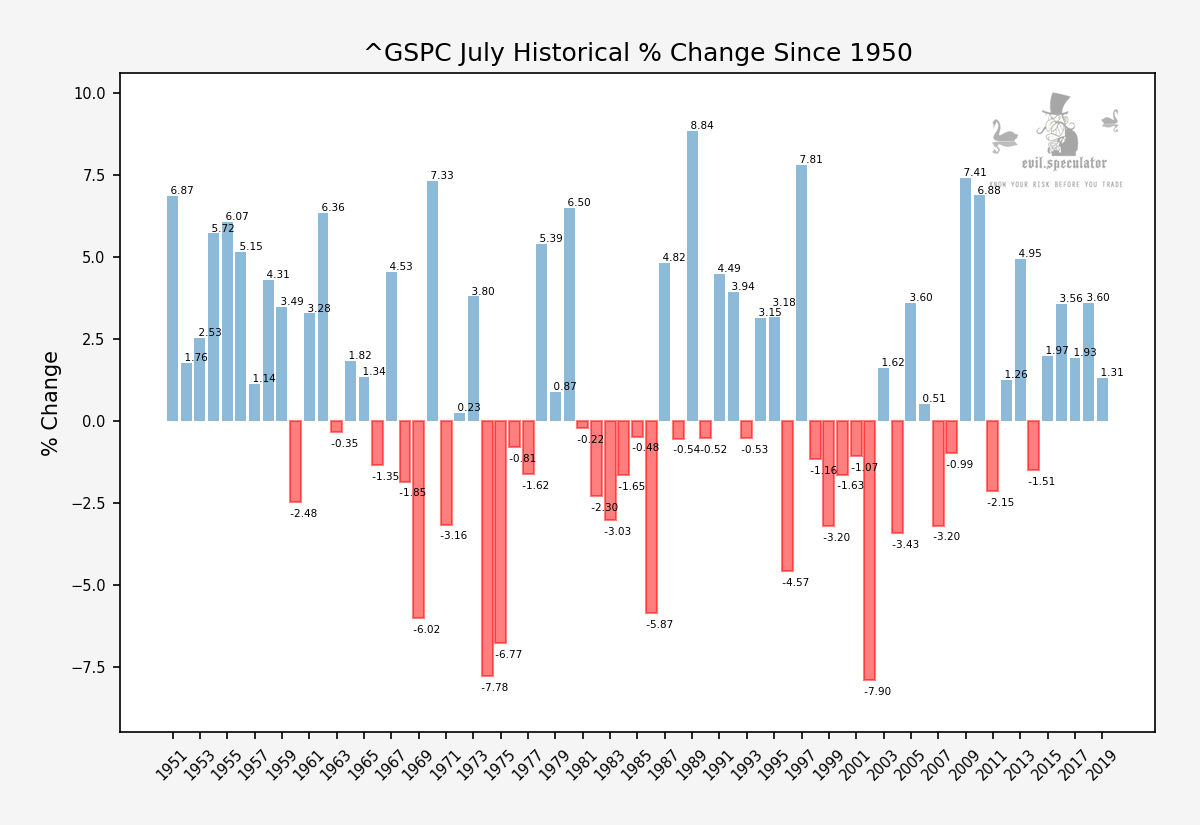

Here’s each week #28 since 1950 – there seems to be sort of a cycle that oscillates between bullish and bearish. The current cycle that started in 2015 suggests a slight bullish bias. Again, just don’t expect any large outliers.

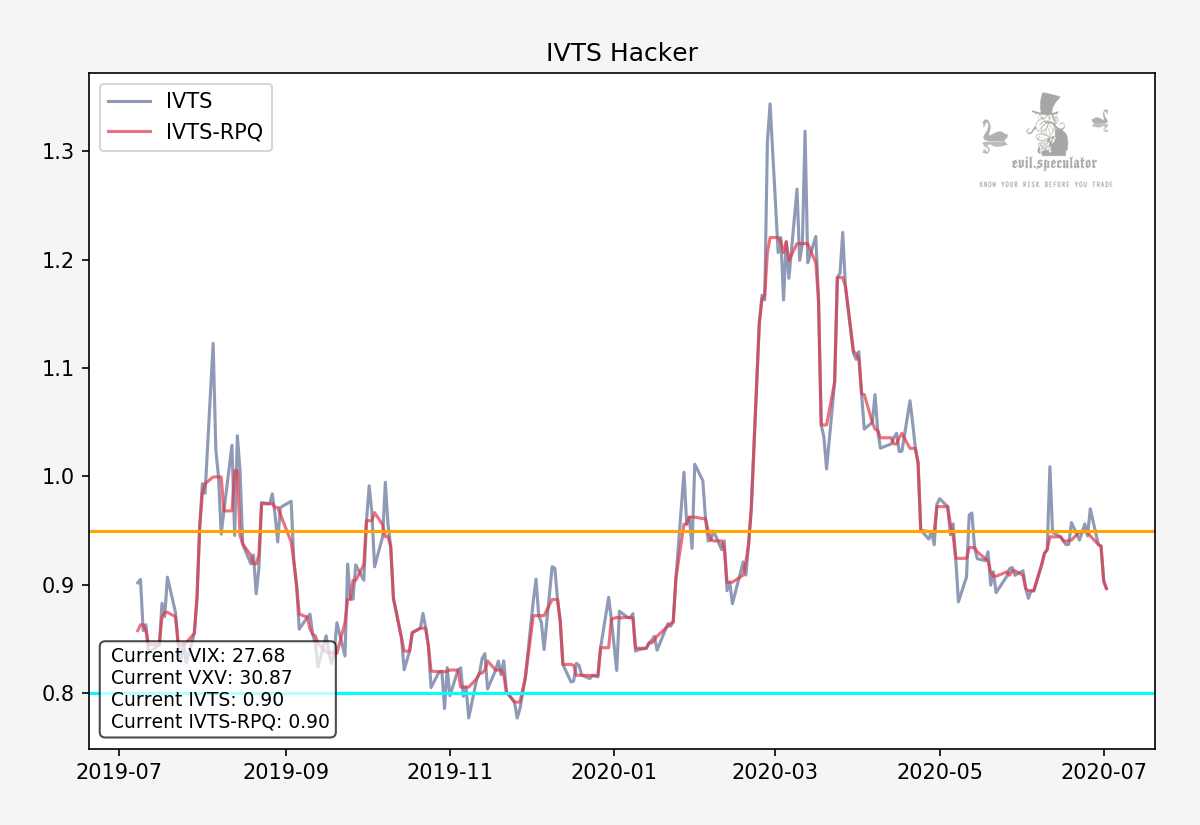

Finally the IVTS once again correctly predicted mean reversion toward the control line, and I hope you took this into consideration instead of paying attention to all the bearish propaganda we’ve been inundated with. Right now both signals are dropping in unison, once again confirming a neutral stance with a slight bullish bias.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]