If you recall my Monday post then you probably remember that week #24 historically closes flat but can produce quick wipeouts typical to what we see in low participation summer tape. And just looking at my trusted Zero indicator signal yesterday made it crystal clear that the bots were running the session. Instead of relying on complex indicators or silly wave counts let’s instead look at what price is telling us.

No big spikes at the open – no big surprise covering. From there the signal remained squarely negative but with minimal participation. What stands out the most IMO is that there was not a single attempt to retest VWAP, which again strongly suggests a bot driven sell off.

Those big spikes at the EOS seem like a tug-of-war between big sellers and big dip buyers or it may have to do with the fact that we just rolled into the September contract, the real spoo (or spu) – ESM20 options expire next Friday but most participants were rolling futures contracts yesterday and many still holding June will most likely roll today.

Also behold the large bearish divergence on the hourly panel (left) which I marked with red arrows. I think it was pretty clear on Monday already that we’re not going to see a positive week. That said – the massive sell off yesterday took retail quite by surprise, me included.

The VIX has responded in kind by spiking deep into bearish territory. That’s disconcerting as we just started to see signs of normalization.

VVIX (realized volatility of implied volatility) is back at its early May highs. I like mid spring as much as the next guy but that’s not a good thing.

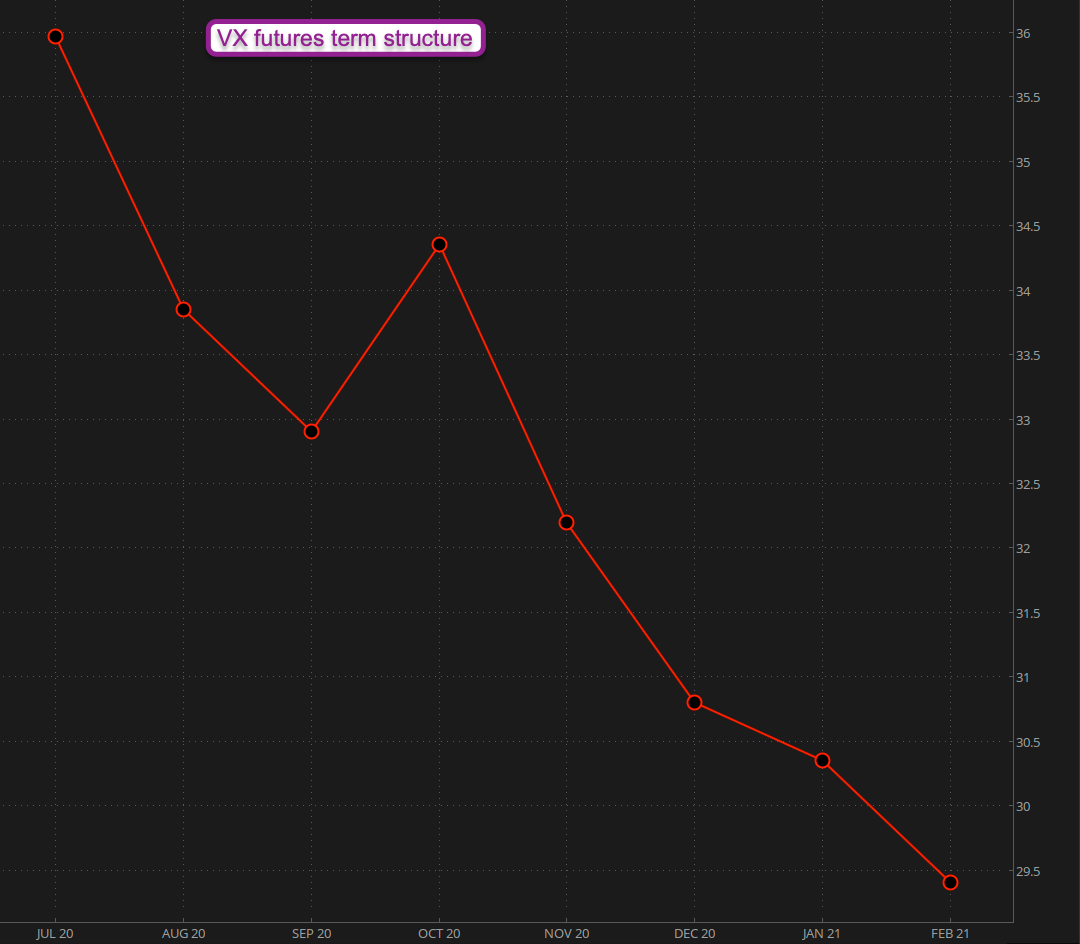

I spoke about the VIX Shark Fin formation the other day and although it’s still there we now observe a massive steepening of the backwardation in the VX term structure.

Backwardation in case you forgot is a phenomenon in the futures market when the front month contract trades at a premium to the 2nd month contract, which in turn trades at a premium to the 3rd month contract, and so on. This is the situation we have been facing since early March of this year and it has persisted until now.

The E-Mini futures effectively painted a 2 standard deviation (or 2-sigma) move in one single session. But that’s nothing compared with what we’re seeing on some of the other indices…

[MM_Member_Decision membershipId='(2|3)’]The Russell 2000 futures (now RTY) descended a full 2 standard deviations – and for the week it’s down 3 std-devs. I labeled this incorrectly on the chart, apologies.

Not to be outdone, the Dow futures (YM) dropped 4 standard deviations in one single session. It’s been the weakest link in the E-Mini contracts and although it’s not overly surprising that it would lead on the downside it is still one massive move comparable to what we saw back in February and march.

The NQ on the other hand still remains within its weekly expected move. That’s incredible and once again that big tech completely dominates the entire equities market right now.

TLT (bonds) are UP UP UP – no big surprise there. Still that was a 3 sigma move this week and it may not be done yet.

HYG (a junk ETF) only down 2 sigmas – I would have expected more carnage there but junk bond holders do not seem to be overly nervous and only sort of went with it for show.

Finally, gold which completely missed out on all the fun and remains mired in a sideways churn of hell. Seems like someone forgot to send the gold bug a memo yesterday that it was rally time.

Bottom Line:

A big surprise wipe out never matters on its own. What really counts is the follow up which we’ll be able to observe today and early next week. Based on whether equity traders are eager to take advantage of a dip buying opportunity or not we will be able to plot a course for the remainder of the summer.

[/MM_Member_Decision]

[MM_Member_Decision membershipId=’!(2|3)’]

Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]

[MM_Member_Decision isMember=’false’]

Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]