If there was ever a valuable lesson to be learned about the utility of the mainstream media in the context of trading the financial markets, then the global Corona train wreck will undoubtedly be recognized by future generations of traders as a textbook example.

Over the past few months we have been drinking from the proverbial firehose of fear, uncertainty, and confusion, casting doubt on pretty much every aspect of our modern lives. And after an initial panic wipe out what did the financial markets do? Happily churn higher day after day after day…

So let’s take stock of where we are and where we’ll most likely go from here. On the SPX (shown above the ES futures which is almost identical ahead of the roll-over) we have:

- A breach of a daily NLBL.

- A breach of the psychologically important 3k mark.

- A brach of the 100-day SMA.

- A breach of the 50-week SMA.

- A breach of a weekly NLBL.

- A breach of the 200-week SMa.

That’s all in the bag now and what was once seen as overhead resistance now sits below as a mighty cluster of support. My post should end here but since I’m on a roll…

The next two sessions are going to be interesting as the spoos are approaching the weekly EM again and the I’m curious if they get pinned nearby again like last week.

That in itself isn’t particularly mind boggling of course but it is a sign that we may be approaching a state of normalization again, at least for the foreseeable future and until the presidential election craziness starts picking up steam.

On the Russell it seems that its weekly EM is going to be blasted to the smithereens – unless we see a major reversal that pulls us back inside.

Heck, even the DOW is catching a bid now and it seems eager to catch up with the rest of the pack. Sector rotation anyone?

[MM_Member_Decision membershipId='(2|3)’]

That indeed seems to be the case. In fact my monsters of tech composite has taken quite a hit in the past few days. Not a big surprise of course as big tech seems to be tripping all over Trump right now.

The VIX has been camped just above the 25 mark and seems to be establishing a base. Apparently that is as relaxed as it’ll get when it comes to valuing downside risk for the foreseeable future.

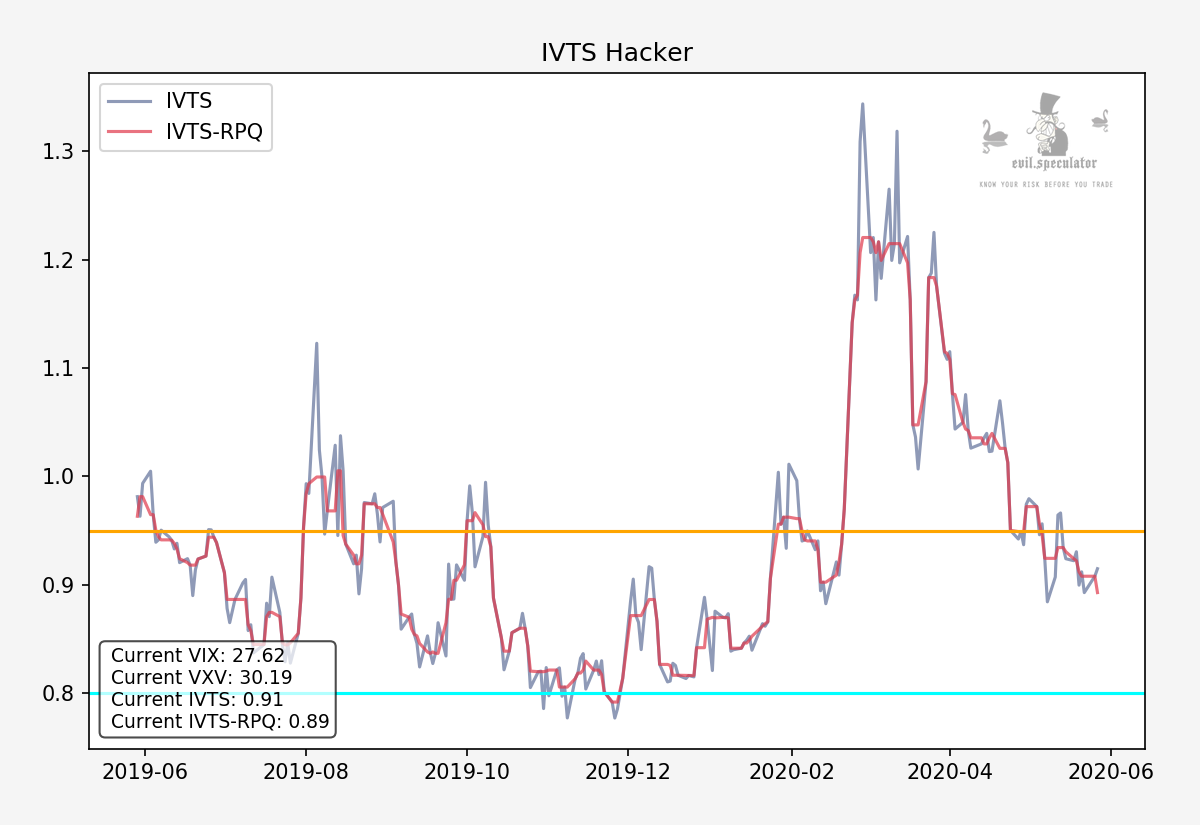

The IVTS is now back in what Tony and I consider ‘normal territory’ – i.e. below the 0.92 mark. This is the threshold that separates medium and low risk environments from high risk environments.

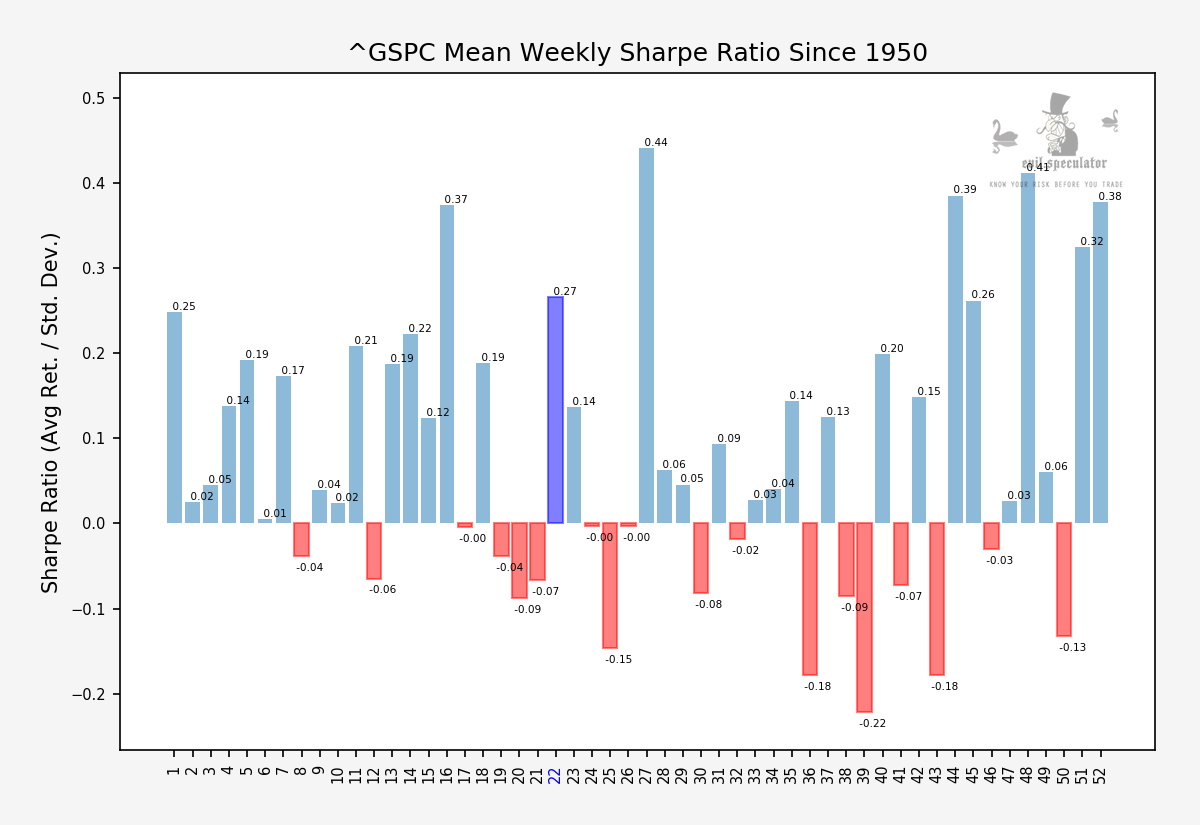

A word of caution: Statistically speaking week #22 is one of the best in spring followed by possibly another bullish week starting next Monday.

After that the summer doldrums are starting to kick in as we transition into what usually is the vacation season. Of course since most people won’t be traveling far this year the whole ‘sell in May and walk away’ maxim may not hold up this year.

[/MM_Member_Decision] [MM_Member_Decision membershipId=’!(2|3)’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.[/MM_Member_Decision] [MM_Member_Decision isMember=’false’] Please log into your RPQ membership in order to view the rest of this post. Not a member yet? Click here to learn more about how Red Pill Quants can help you advance your trading to the next level.

[/MM_Member_Decision]